Sustain the care our community counts on.

Some description text for this item

Every day, people face barriers to accessing affirming, lifesaving care. Prisma offers a space to access mental health support, HIV prevention and care, and 2SLGBTQIA+ health care that makes people feel safe, seen, and supported.

Your gift helps Prisma’s work continue to advance.

Prisma Community Care is a Qualifying Charitable Organization for the Arizona Charitable Tax Credit Organizations Code (QCO: 20670). This is an opportunity to turn your Arizona State taxes into a force for good.

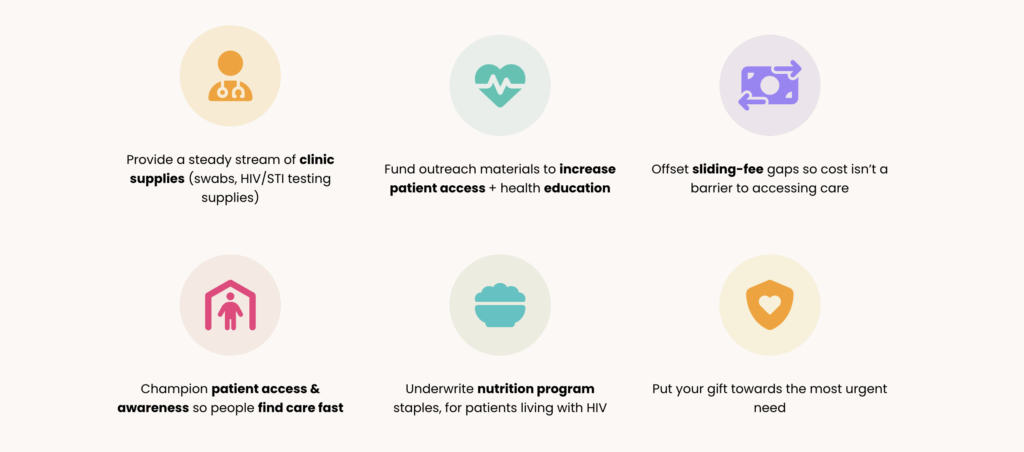

What your donation supports.

Monthly or one-time, your support keeps shelves stocked, outreach moving, care affordable, and helps first-time patients discover and reach us when they need it most.

Kyle’s parents came to Prisma Community Care seeking mental health care for their son. What they found was life-changing. With consistent care, Kyle began to thrive. Now he walks through our doors with confidence—because your support made it possible.

“She has helped him so much… He says she listens to him, makes him feel important, and helps him a lot.”

— Kyle’s Parents

Join us in building a healthier, more inclusive Arizona.

Your gift helps Prisma’s core work continue to advance. Watch the video to learn more about our mission and how we serve our patients and community.

More ways to give!

Contact us today at [email protected] or click below to discover other ways to support our community.

Pledge your continued support to our community through a monthly gift. For as little as $5 a month, the cost of providing 25 free condoms to clients, you can make a real difference in peoples’ lives.

Checks should be made payable to Prisma Community Care and mailed to:

> Prisma Community Care

Attention: Fundraising and Development

1101 N. Central Avenue, Suite 200

Phoenix, AZ, 85004

With the Arizona Charitable Tax Credit, you can get up to $987 (household) or $495 (individual) off your taxes by supporting the Prisma Community Care. This means that your get to support your community, and when you file your Arizona State Taxes, you get the money you donated right back in your pocket!

Questions about the process? Contact us at [email protected].

The Prisma Community Care is always looking for in-kind items to use at our fundraisers or to support our clients. If you are interested in donating items for hygiene kits to assist our clients who are experiencing homelessness or other forms of housing insecurity, contact [email protected].

Prisma Community Care’s Safe Space provides a space and resources for clients in need. To support our Safe Space, please check out our “”Wish List” or email [email protected] for more information.

Did you know that your company may double the value of your donation to the Prisma Community Care?

Many businesses offer matching gifts to help their employees maximize the impact of their support. Some companies will even match gifts for hours volunteered and for gifts made from their retired employees!

Check here to see if your company will match your contribution and for instructions on how to submit a matching gift request:

If you don’t find your company on the list, see your human resources department for instructions or ask them to start a matching gift program.

Business owners and HR directors: If you are looking for an organization to offer matching gifts in support of queer and LGBTQIA+ healthcare and wellness, the Prisma Community Care is the organization for you! Contact us at [email protected].

Do you shop at Fry’s Grocery Stores? If so, you can support Prisma Community Care just by doing the things you already love! Learn more about Shop & Support programs here:

Fry’s Community Rewards

You can support Prisma Community Care just by shopping at Fry’s. It’s easy when you enroll in Fry’s Community Rewards! To get started, sign up with your VIP Card here, and enter NPO #81749 for Prisma Community Care. Once you’re enrolled, you’ll earn rewards (rebates) for us every time you shop and use your VIP Card!

If you are already participating in this program – THANK YOU and please remember to re-register your VIP Card every year.

Prisma Community Care hosts several Fundraising, Testing, and Community Outreach events each year. Sponsoring an event can be a great way for your business to show-off it’s charitable side and gain amazing exposure within the Phoenix community! Learn more about becoming a sponsor by contacting us at [email protected].

Donations to our organization might be eligible through your workplace’s United Way workplace campaign. Call the Valley of the Sun United Way agency certification line at 602.631.4813 to confirm eligibility within your workplace campaign. Then it’s as simple as choosing to direct your monthly United Way donation to Prisma Community Care!

Gifts of appreciated securities and closely held stock can be beneficial both to you and Prisma Community Care. You may receive an income tax deduction equal to the fair market value of the securities, as well as reduce or eliminate capital gains taxes. Gifts of stock and mutual funds are coordinated by Prisma Community Care. Proceeds from the sale of these assets benefit the Prisma Community Care may be directed to specific programs as well as general operations.

To arrange a gift, you or your broker may contact our Fundraising and Development Team at [email protected].

A gift in honor of a loved one or in celebration of a special event provides a meaningful way to remember a special person or milestone and benefit Prisma Community Care. Each gift is acknowledged to the person, or to the family of the person, in whose honor or memory the gift was made. The gift amount remains confidential. A separate receipt is sent to the donor. Below is suggested wording for memorial donations:

In lieu of flowers, please make donations payable to Prisma Community Care and mail to:

> Prisma Community Care Attention: Fundraising and Development

1101 N. Central Avenue, Suite 200

Phoenix, AZ 85004 *

You can extend the influence of your generosity beyond your life through a planned gift. You can also experience the joy of giving while minimizing the personal cost of a major gift through charitable tax benefits.

Many planned giving vehicles exist, some of which are listed below:

Wills and bequests

Gifts of securities

Charitable remainder trusts

Charitable lead trusts

Gifts of a personal residence

Wealth and asset replacement trusts

Gifts of life insurance

Retirement funds

Donors are advised to seek and rely upon their own independent legal and/or accounting counsel in matters relating to bequests and deferred gifts, particularly with reference to tax considerations and estate planning. An advisor will assist you in creating a charitable gift that will take into account the types of assets you have, your wishes, and the state and federal taxes that apply to your individual situation.

Please contact us at [email protected] for more information.